In a Nutshell: Comparing bank rates can be cumbersome if you don’t have the right tools. BestCashCow equips consumers with resources to compare bank rates and products efficiently. The site assesses a bank’s commitment to renewable energy so consumers can support institutions whose environmental goals align with their own. BestCashCow’s interactive calculators allow users to understand the impact of fluctuating conditions on their investments.

Before the internet, consumers searching for a savings account or CD with which to grow their money may have scoured their local newspaper for promotional bank rates. Others may have simply stopped by their local bank branch to determine which products yielded the best rates.

The internet has changed the way people shop for many items, including financial products and services. But consumers planning to visit the websites of every financial institution in the country to assess their deposit rates will find it’s not a process they can complete in minutes.

BestCashCow provides lists of bank rates and product information to help consumers compare and contrast the offerings of financial institutions across the country.

We caught up with Ari Socolow, BestCashCow’s Chief Economist, to understand the site’s features and how they help guide consumers toward financial health.

Socolow helped found BestCashCow in 2005. At that time, online banking was growing in popularity, and consumers were turning to the internet to find reviews of banking products and services.

Consumers were becoming increasingly attracted to online banks, whose lack of brick-and-mortar infrastructure enabled them to offer competitive savings rates.

Socolow said some websites at the time listed the rates offered by national banks, but BestCashCow also provided consumers access to information about local bank rates.

“At our outset, the local rate environment was very competitive, but it couldn’t be easily explored online,” Socolow said.

The lack of online information about local banks and their products inspired BestCashCow’s founders.

“It occurred to my partners and me that there was an opportunity not just to list the information for the five or six biggest banks emerging in this space but to also give exposure to small, local banks and other financial institutions,” Socolow said.

Assessing a Financial Institution’s Sustainability Practices

Consumers use the internet to compare rates across financial institutions, but Socolow said they also desire to understand a bank’s philosophy around sustainability.

BestCashCow assigns banks a climate grade that scores their commitment to funding renewable energy projects and their involvement with fossil fuel lending.

Socolow said the financial system can be an impediment to addressing climate change, and the largest banks in the U.S. have significant exposure to oil and gas projects. He believes some banks benefit financially from delaying a quick and meaningful transition to renewable energy.

“It’s becoming much more important for people to put their money into banks that will be on the right side of history,” Socolow said. “People can now find out if their bank is engaged in the financing of wind and solar technologies and avoiding funding oil, gas, or coal projects.”

BestCashCow employs a team of researchers who unearth a bank’s commitment to combating climate change. Socolow said BestCashCow is the only comprehensive source of rate information that also assigns banks a grade for their sustainability practices.

Some banks may solely fund clean energy projects, while others may fund a mix of projects that expose them to both fossil fuel and clean energy endeavors.

Socolow said assigning banks a letter grade for their commitment to renewable energy projects may motivate people to support institutions that have better climate grades and offer attractive rates.

“For most banks, there’s very little information available out there about their stance on supporting sustainable practices,” Socolow said. “But there is information we’ve been able to find to highlight institutions that support renewable energy projects.”

Banks that earn the highest marks on BestCashCow’s climate grades are those that do not participate in funding projects that produce carbon or otherwise damage the environment.

Financial Education Guides Consumer Choices

BestCashCow newsletters educate users who want to learn more about bank products and rates. The company publishes weekly newsletters about deposit and consumer loan products and a monthly newsletter devoted to credit cards.

BestCashCow hosts a plethora of financial education articles for consumers interested in learning more about bank products and changes in the interest-rate environment.

Consumers desiring more information on specific topics can download free ebooks from the site. BestCashCow offers ebooks about saving strategies, rewards credit cards, CDs, and mortgages.

The site’s resources are a one-stop shop for consumers seeking to increase their financial knowledge and health.

A calculator that computes compound interest allows users to understand how different interest rates and tax considerations can impact an investment’s growth.

Consumers considering whether a high-interest savings account or a CD would be a better addition to their portfolio can employ BestCashCow’s savings and CD comparison tool, which allows users to compare products from multiple financial institutions.

The site posts savings promotions from banks and credit unions to help users track deals only available for a limited time.

For users just starting to build an investment strategy, BestCashCow offers an income guide that provides an in-depth overview of the different investment vehicles that can help consumers reach their financial goals.

The site calls attention to a financial institution’s historical rate activity so users can assess which banks have recently changed their rates and whether they have tended to decrease or increase their rates over time.

“We’re kind of reaching a plateau in that it’s very uncertain which way savings rates are going to move in the future,” Socolow said. “If you’re thinking about opening a new savings account, it’s good to know if a bank is very fast to lower their rates.”

Providing historical rate data is another way BestCashCow can save consumers time.

“We provide users with a bank’s recent rate changes so they can see which direction they’re going without having to do any further research of their own,” Socolow said.

Tracking Thousands of Data Points to Ensure Accuracy

BestCashCow initially focused on providing local and national bank rates, but as the company grew, it began to include credit union products in its comparisons.

Many banks and credit unions target prospective customers within a particular geographic area, but other financial institutions accept deposits from consumers and businesses anywhere in the U.S.

Socolow said BestCashCow’s team of researchers spends significant time reviewing the products and services banks and credit unions offer nationwide.

In addition to deposit products, the site provides consumers information about lending products, including mortgages and home equity lines of credit.

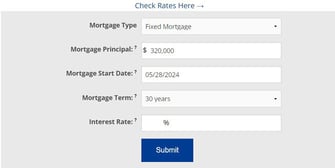

BestCashCow’s interactive mortgage calculator allows users to input different product rates and terms to understand how they can influence monthly mortgage payments.

Consumers who are open to banking with lesser-known names in the financial services space may be able to access more advantageous rates and terms.

“A lot of the largest banks have become less competitive,” Socolow said. “They generated tremendous deposits, and then they really stopped competing on the rate front. And I think a lot of people need to wake up to the fact that they no longer offer the highest rates in the market.”

BestCashCow’s team updates hundreds of thousands of rates to provide consumers with comprehensive and timely information so they can make informed financial decisions.

“We always stay on top of the latest information and have employed a lot of people for a long time to try and keep everything updated for our users,” Socolow said. “People can gain a lot of value from looking closely at a site like ours that has more detailed information than other sites.”