Garnishment happens when a court allows a creditor (i.e., the person or company you owe money to) to take part of your paycheck or money from your bank account to pay debts such as credit card bills, child support, back taxes, medical bills, or loans that you haven’t paid.

In this guide, we’ll explore the circumstances that lead to garnishment, what creditors can take, and how to avoid it altogether.

How Garnishment Works

Garnishment is a court-ordered process for creditors to collect money you owe by taking it directly from your paycheck or bank account. Federal and state laws regulate several forms of garnishment to address various debt-related situations.

Laws and Regulations

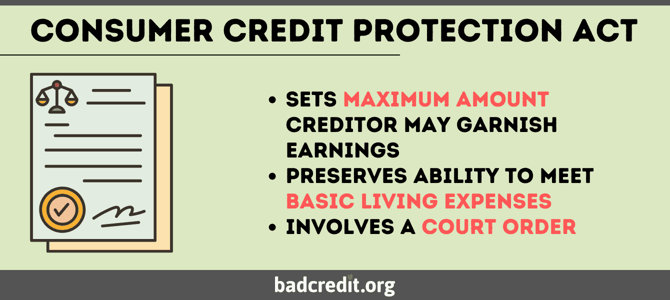

Federal and state laws set the rules for garnishment. Federal laws put limits on how much money a creditor can take from your paycheck. The Consumer Credit Protection Act (CCPA) sets the maximum amount that a creditor can garnish from your earnings while ensuring that you have income left to meet your basic living expenses.

State laws can add more rules, such as lower limits on the garnished amount or protections for certain types of income.

Garnishment is different from other forms of debt collection because it involves a court order. Other debt collection methods may have creditors calling you, sending letters, or trying to negotiate payment plans.

If the court decides in favor of the creditor, your employer or bank automatically takes the garnished amount from your earnings or bank account and sends it to the creditor’s account. This means the creditor no longer needs to hound you for payment.

Types of Garnishments

Garnishment can happen in several different ways, depending on what the court decides. Here are five common types:

- Wage Garnishment: This is when the court orders your employer to take out a certain amount of money from your paycheck before you get it. This money goes straight to the creditor you owe. It’s a direct way for them to collect the money you owe from your earnings.

- Bank Levy: In this case, the creditor gets permission to take money directly from your bank account. This means they can take the money you have in your account to cover the debts you still need to pay. It’s a one-time seizure of funds available in your account at the time of the levy.

- Property Lien: A lien is a legal claim against your property, such as your house or car. This doesn’t mean the creditor takes your property. Instead, the lien prevents you from selling or refinancing your property without paying off the debt first. The creditor has a claim to the proceeds if you sell the property.

- Child Support and Alimony Garnishments: These are special types of wage garnishments for child support or alimony payments. In these cases, the court orders can allow more than the usual garnishment limit of 25% of disposable income if you are behind on payments. The purpose is to ensure that you make the payments meant for the support of a child or former spouse in a timely manner.

- Tax Levy: The IRS or state agencies use this type of garnishment if you owe back taxes. The IRS doesn’t need a court order to begin garnishment for taxes owed. It can take a substantial portion of your wages or seize funds from your bank account directly.

Each type of garnishment helps creditors get paid back in different situations, whether through your regular income, your bank account, or a property lien. The last two garnishment types reflect specific legal obligations (e.g., child support, alimony, or taxes) that receive the highest priority.

Reasons for Garnishment

Garnishment happens for several reasons, mainly when you haven’t paid debts such as child support, alimony, taxes, or loans. Here’s how it works simply:

- Child Support and Alimony: If you don’t pay child support or alimony, the court can order part of your wages to be taken to ensure your family or ex-spouse gets the support they need.

- Taxes: If you owe taxes, the IRS or state tax agencies can take money from your wages or your bank account. This is their way of making sure they collect the taxes you owe.

- Unpaid Loans and Credit Cards: If you haven’t paid back your loans or stopped making credit card payments, lenders can sue to have your wages garnished. They usually do this after other methods, such as phone calls or letters, have failed.

Garnishment is usually the last step creditors take to ensure you pay your debts.

Role of Employers and Financial Institutions

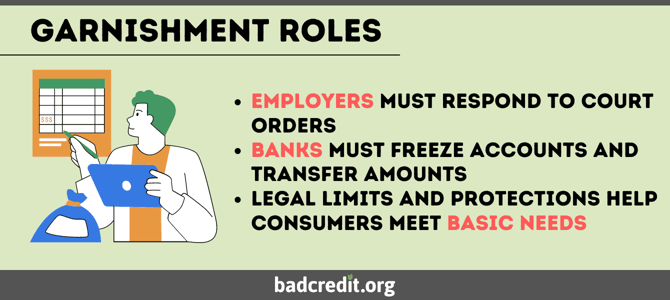

Garnishment involves not just creditors and courts but also employers and banks, which play key roles in the process. Knowing what these institutions can do may help you understand how garnishment works and what your rights are.

Employers’ Obligations

When a court orders your wages garnished, your employer must take out a part of your paycheck as the order specifies. Employers send the money to the designated recipient. If you have just one garnishment, federal law protects your employer from firing you. However, your employer can legally fire you if you have more than one garnishment in a year and the situation becomes difficult to manage.

Employers must follow the rules to avoid legal issues from not complying with the garnishment order. This setup helps ensure that everything is done fairly and that you receive protection from excessive hardship due to garnishment.

Responsibilities of Banks During a Bank Levy

The bank also has to follow a set of rules when a court puts a levy on your account. First, the bank freezes your account when it receives notice of the levy. This means they stop all activity on your account. The bank can only take out the amount of money that the court specifies.

The bank must leave the rest of your money alone, especially if some of it is protected by law. The bank has to manage this process carefully to ensure it follows the law and protects your rights.

Limits and Protections for Garnished Individuals

Garnishments must observe legal limits and protections to help make sure you have enough money for basic needs such as food, clothes, and housing costs. The Consumer Credit Protection Act (CCPA) has set a rule that a garnishment can take only up to 25% of your disposable earnings (the money you take home after taxes and other mandatory deductions).

If your earnings are very low, the amount taken may be even less. Creditors can only take 25% or the amount your disposable earnings exceed 30 times the federal minimum hourly wage in a week — whichever is less.

Also, some types of income, including Social Security benefits, disability payments, and veterans’ benefits, are usually immune to garnishment. These rules exist to ensure you still have enough income to live on, even when your wages are garnished.

Calculation of Garnishment Amounts

When a court orders garnishment, it decides how much money to take from your paycheck or bank account based on certain rules. Let’s look at some examples that illustrate how this works.

Disposable Income and Its Impact on Garnishment

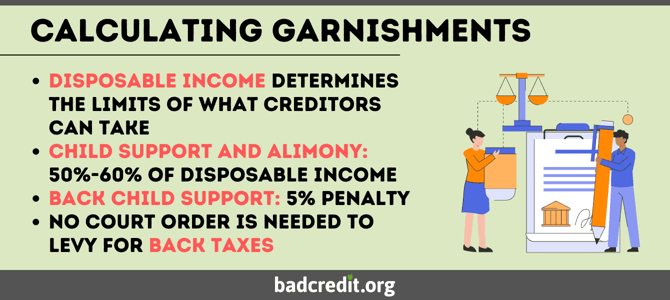

Disposable income plays a crucial role in determining garnishment amounts. It is the amount of money you have left after all mandatory deductions to your paycheck, including taxes, Social Security, state unemployment insurance, and other required payments. Essentially, it’s the money you actually take home that is available for everyday expenses.

Disposable income is important for garnishments because it sets the limit on how much the creditor can take from your paycheck. Federal and state laws use this figure to ensure that creditors receive payments you owe them, but you still retain enough income to support yourself and meet your essential needs.

The garnishment rules balance the creditor’s right to collect a debt with your need to maintain a minimum standard of living. As previously mentioned, federal law limits the garnished amount to 25% of your disposable income for debts, including credit card bills, medical bills, and personal loans. However, this percentage can vary depending on the type of debt.

Using disposable income to calculate garnishment helps protect you from a financial crisis. It allows you to continue to cover basic living costs while still fulfilling your debt obligations.

Special Rules for Child Support and Tax Debts

As mentioned earlier, the laws give priority to child support and alimony payments, reflecting the priority of family obligations over other types of debt. Tax debts also have special rules.

Child Support and Alimony: For child support and alimony, the amount that the court can garnish from your disposable income can be higher than 25% because supporting your children or ex-spouse is a priority. The federal limits are as follows:

- The garnished amount can reach 50% of your disposable income if you are currently supporting a spouse or child.

- The court can take to 60% if you are not supporting a spouse or another child.

- Additionally, the court can add another 5% if you are more than 12 weeks behind on child support payments. This garnishment can be as much as 65% of your disposable income.

States basically follow the federal rules for child support and alimony, but they usually refine them by adopting one of the following calculation models:

- Income Shares Model: This method uses the combined income of both parents. Each state calculates this differently. For example, Massachusetts treats both parents as if they were caring for the child. The parent with a higher income pays the difference to the other.

- Percentage of Income Model: This approach uses a set percentage of the non-custodial parent’s income. It ignores the income of the custodial parent. In Alaska, for instance, if the non-custodial parent earns $2,000 monthly, they have to pay 25% (i.e., $500) per month.

- Melson Formula Model: This is similar to the Income Shares Model, but it adjusts the support amount according to changes in parental incomes. In Montana, this model combines the income of both parents. It then divides this according to each parent’s share of revenue. It also incorporates personal allowances for the number of children in the family.

Each model attempts to make the support payments as fair as possible. Check with your state government to see which one applies to you.

Tax Debts: For back taxes, whether owed to the IRS or state tax agencies, the garnishment rules can be quite aggressive:

- The IRS does not need a court order to levy wages for unpaid taxes.

- The amount levied depends on your filing status and how many dependents you have. The IRS follows a detailed table to determine the exact amount exempt from levy; it can use the rest to cover your tax debt.

- Typically, the IRS can end up taking a significant portion of your paycheck if you have a substantial tax debt, often more than what other types of creditors can take.

The higher limits reflect the priority of child support and tax debts. Child support ensures that children receive the necessary financial help. Tax debts involve money owed to the government, which supports public services and infrastructure.

Example for Standard Debts

Say you earn $1,000 every two weeks after taxes and other deductions.

Total Biweekly Disposable Income: $1,000

Maximum Biweekly Garnishment (25%): 25% of $1,000 = $250

The creditor can legally garnish $250 every paycheck until you repay the debt.

Example for Child Support

A highly paid individual needs to pay the required child support. This person earns $10,000 per month of disposable income, doesn’t support another spouse or child, and is more than 12 weeks behind in child support payments.

Here’s the calculation:

Total Monthly Disposable Income: $10,000

Base Percentage for Garnishment: 60% for child support since they are not supporting another child or spouse

Additional Percentage for Being Behind: An extra 5% because they are over 12 weeks behind

Total Percentage for Garnishment: 65%

Monthly amount Garnished: 65% of $10,000 = $6,500

In this example, the court garnishes $6,500 from the non-custodial parent’s monthly disposable income to cover the overdue child support.

How Garnishment Impacts Consumers

Garnishment can decimate your income and severely damage your credit. That should provide sufficient motivation to pay your debts and avoid garnishment.

Potential Credit Score Effects

Your credit reports will enshrine your garnishment for all types of parties to see, including lenders, employers, landlords, and others who view your reports. It’s not as damaging as bankruptcy, but it’s a significant blow to your credit because it remains in your report for seven years.

Unless your credit is terrible already, garnishment will drive down your score quickly. Be prepared to see rejected applications for credit cards and loans. If you do qualify, you’ll no doubt face high fees and interest rates.

The only silver lining is that your score will slowly recover, especially if you make good financial decisions. You could repair your score within a few years through diligence and consistency.

Employment and Financial Consequences

If you are concerned about your employment prospects, the last thing you want is for a garnishment to appear on your credit reports. Employers who see it may immediately think you can’t handle the job because you can’t handle your finances.

Now, your boss can’t fire you for a single garnishment, according to federal law. But two or more garnishments dissolve this protection, and your employer can terminate you immediately.

Of course, the bigger the garnishment, the less money you have to live on. This can lead to some serious belt-tightening. You will be doing well if you have enough money left over to pay for housing, food, and utilities.

Additionally, garnishment makes it harder to pay off other existing debts. Your credit score will suffer if you miss payments or let your debts balloon. It’s a mess that you should avoid.

Repercussions of Ignoring Garnishment

Ignore a garnishment order at your own peril. The court can throw the book at you if you thumb your nose at it. At the very least, your legal costs will climb, and you may be hit with new fines.

If you feel that garnishment isn’t warranted, you can fight it in court. But you may have to pay interest on your unpaid balance if you lose. The compounding damage of garnishment can make it much harder to get out of debt.

Furthermore, failure to own up to your responsibilities can land you a contempt of court sanction. Now we’re talking about big penalties and possibly even time behind bars. The question becomes: How much pain are you willing to endure before you put an end to it? As you’ll see below, bankruptcy court may be your best option if you can’t meet your financial obligations.

Ignoring a garnishment order can make your life a living nightmare. You’ll end up owing more because of additional penalties, legal fees, and interest. A word to the wise: Fix your debt problems before the court gets involved.

Debtor Rights and Legal Protections

I discussed the federal and state rules governing garnishments earlier. As you recall, the federal Consumer Credit Protection Act (CCPA) spells out the relevant guidelines, including the maximum you must pay and what income is exempt from garnishment. I also explained the three models states use to enforce and calculate garnished amounts.

Notice and Due Process Rights

When it comes to garnishment, you have specific due process rights designed to protect you before creditors access your wages or bank accounts. Here’s a detailed look at those rights.

Right to Receive Notice Before Garnishment Begins

You should receive a formal notice from the creditor (or its lawyer) before the start of a garnishment action. In some cases (i.e., back taxes or child support), the IRS or the state child support enforcement agency may send the notice.

The notice will describe what you owe, who you owe it to, and what you can do to avoid a court case. You’ll learn the details of the garnishment process, and you’ll have a chance to respond before it’s too late.

Opportunity to Dispute the Debt or Judgment

You can dispute a garnishment notice if you think it’s wrong. Check for errors involving the amount owed and the creditor’s identity. Don’t hesitate to file a court motion to stop the process — you have 30 days to do so once you receive the notice. Be prepared to present the court with evidence as to why the proposed garnishment is incorrect or unfair.

Be thankful that you have the right to challenge a garnishment action. It helps ensure a fair process in which everyone gets their say.

Bankruptcy as a Protective Measure

Filing for bankruptcy can halt most garnishment orders right away. This is because of something called an automatic stay, which is a rule that stops creditors from taking your money once you file for bankruptcy.

The automatic stay means that as soon as you file for bankruptcy, most creditors cannot garnish your wages, take money from your bank account, or continue with lawsuits against you. This may give you time to sort out your finances without undue pressure.

However, there are exceptions. Automatic stays do not stop garnishment for child support or alimony.

An automatic stay also does not remove any existing IRS liens on your property when you file for bankruptcy. The automatic stay only prevents the IRS from performing any new liens, wage garnishments, or asset seizures.

Both common bankruptcy chapters can stop garnishments.

- Chapter 7 bankruptcy clears many of your debts. Once you file, garnishments stop, and most of your debts are paused, including credit card and medical bill debts. You may have to sell non-exempt assets to cover your debts.

- Chapter 13 bankruptcy involves making a plan to pay back your debts over time. Filing for Chapter 13 stops garnishments, and you may end up paying only a part of what you owe.

Each type of bankruptcy offers different benefits, so it’s important to choose the one that best fits your financial situation. Speak to a professional for advice.

How to Avoid Wage Garnishment

Wage garnishment is painful and damaging. You’ll have to live on a smaller income as you watch your credit score sink. Here are some ways to avoid this fate.

Communicate with Creditors

Talking to your creditors is a key step if you are having trouble paying your bills. It’s better to reach out to them before things escalate to a garnishment order.

You can offer to negotiate with creditors and set up a payment plan that fits your budget. Some creditors may even agree to a settlement, where you pay a lump sum that is less than the total you owe. However, settlements appear on your credit report and also damage your credit score.

Explain your situation to your creditors if you experience financial hardship. Provide the details of your income, expenses, and any unexpected events (such as job loss or medical emergencies) that have compromised your ability to pay. This can help them understand your situation and may make them more willing to work with you.

However, be aware that some creditors play hardball and may not compromise.

Obtain any payment plan or a settlement you work out in writing. This agreement should detail the terms of your arrangement, including the amount you have to pay, the schedule, and what happens once you settle the debt. This protects both you and the creditor and prevents confusion about the agreement’s terms.

Taking these steps can help you avoid garnishment. That’s why it’s so important to open a line of communication with your creditors.

Credit Counseling and Debt Management Plans

Credit counseling agencies help you make a plan to pay off your debts and offer advice on budgeting and money management. They may also negotiate with your creditors to reduce interest rates or monthly payments.

Enrolling in a debt management plan (DMP) through a credit counseling agency can simplify your debt repayment. In a DMP, you make one monthly payment to the credit counseling agency, which then distributes the money to your creditors. The plan could reduce your interest rates and eliminate certain fees.

Initiating a DMP may lower your credit score at first because creditors may close or suspend your credit accounts. However, your consistent payments through a DMP can improve your credit score over time as you reduce your debt. This should stabilize your finances as you rely less on credit.

Overall, working with a credit counseling agency and enrolling in a DMP can be a good way to tackle debt. In the best-case scenario, it could reduce your interest rates and fees while avoiding wage garnishment.

Legal Assistance and Representation

Consider getting legal advice if you face garnishment, have significant debt issues, or need to understand your rights under the law. It’s especially important to talk to a lawyer if a creditor sues for debt.

Look for legal clinics or pro bono (i.e., free) assistance if hiring a lawyer seems too expensive. Many communities have legal aid organizations through which lawyers provide free legal help to people with low incomes. These services can help you with everything from negotiating with creditors to representing you in court.

Hiring a consumer rights attorney can be a good idea if your case is more complicated, such as when you believe a creditor has violated your rights. These attorneys specialize in protecting consumers from unfair practices and can ensure that creditors and debt collectors obey the law.

Getting the right legal assistance can protect you from unfair treatment and help you manage or eliminate your debts. It’s a safer alternative than trying to go it alone. Online legal sites can also help you understand and manage your legal issues regarding debt and garnishment.

Here’s how they can assist:

- Information: These sites often have free information that can educate you about your rights and what you can do about your debt.

- Forms and Documents: They provide forms you can use to deal with your debt, including letters to creditors and other legal documents.

- Advice: Some sites allow you to chat with real lawyers online for less money than meeting one in person. They can answer your questions about your debt.

- Finding Lawyers: These sites can also help connect you with lawyers who can represent you in court or talk to your creditors, sometimes at a lower cost.

Here are some of the leading online legal sites and what they offer:

- LegalZoom: Document creation, legal advice from lawyers

- Nolo: Legal guides, online forms, attorney connections

- Rocket Lawyer: Legal documents and legal advice through a monthly subscription

- Avvo: Directory of lawyers with reviews for various legal needs

These sites can be a starting point for managing your debt issues and understanding more about the legal process.

Dealing with Existing Garnishments

It helps if you understand your options when dealing with an existing garnishment. Let’s explore ways you can manage it.

Review Your Garnishment Order

Verify that the garnishment notice is correct. Check details such as the amount you owe, the creditor’s name, and the deadline for payments. Everything listed must match up with what you know about the debt.

Check that the garnished amount does not exceed legal limits. Most debts should be, at most, 25% of your disposable income. IRS levies, alimony, and child support have higher limits, as I laid out earlier.

Address any errors quickly. You can file a challenge or speak to the court or creditor to correct the information.

The basic task is to carefully review and manage your garnishment order. Ensure that everything is correct and that you are only paying what the law permits. In this way, you can avoid unnecessary charges.

How to Modify Garnishment Amounts

You (or your lawyer) can petition the court to lower the garnished amount if it’s too much for you to manage. Explain your situation and how the current garnishment is making it difficult for you to pay for basic needs such as rent and food.

When you ask the court to lower your garnishment, provide documents that show your income, expenses, and any other financial obligations. This can include pay stubs, bills, and any other proof of your financial situation.

It’s important to act quickly if you want to change the garnished amount. The longer you wait, the more money you’ll owe. Acting fast can help you manage your finances better and avoid additional stress.

Early Payoff Options

You can take steps to resolve your debt under terms that may be more favorable than continuing with garnishment.

Paying off your debt early can stop the garnishment process, which means you’ll have access to your paycheck or bank account balance to use as you need. It may also improve your credit score faster and help you afford basic necessities.

Try cutting back on unnecessary expenses to help you save up the money you’ll need for an early payoff. You can also sell items you no longer need or take on additional work for extra income.

Try negotiating with your creditor to pay a lump sum that is less than the total amount due. Start by contacting your creditor to explain your financial situation and offer a reasonable amount that you can afford to pay immediately. Be ready to explain why this would benefit both parties and remember to reach an agreement in writing.

Voluntary Wage Assignments

A voluntary wage assignment is when you let your employer take money from your paycheck to pay off debts. This differs from a court-ordered involuntary garnishment.

Here’s how to work out a wage assignment with creditors:

- Start Talking: Call your creditor and ask to set up a wage assignment. Make the case that this can help both parties because it delivers regular payments without a costly lawsuit.

- Agree on an Amount: Discuss how much money the creditor can take from each paycheck. But ensure you can still pay for basic needs.

- Write It Down: Write down the agreement and get the document signed. This should allow you to sidestep any confusion later.

Wage assignments make it easier to manage debt, although you’ll receive less money in your paycheck. You can stop a wage assignment at any time by notifying your creditor in writing. But, if you stop, the creditor can still sue you, and the judge may order a garnishment.

Here’s a comparison of the two alternatives:

| ASPECT | WAGE GARNISHMENT | VOLUNTARY WAGE GARNISHMENT |

|---|---|---|

| Initiation | The court orders this as a result of a creditor lawsuit | The debtor and creditor agree to voluntarily |

| Control | The debtor has no control over the process | The debtor initiates and agrees to the terms voluntarily |

| Legal Requirement | Requires a legal judgment and court order | No court order is needed based for an agreement between the parties |

| Cancellation | Only a court order can stop or modify it | The debtor can cancel at any time by notifying the creditor |

| Flexibility | It is fixed by court order, which means less flexibility in terms of payment amount | More flexible as the debtor can negotiate the payment amount with the creditor |

| Impact on Credit | Typically, it has a negative impact due to the nature of forcible collection | Less impact on credit if managed properly, as it shows proactive debt management |

| Legal Implications | May lead to more severe legal consequences if ignored | Adjustment or cancellation have fewer immediate consequences. |

Understand the details of both procedures before you decide which one (if either) to pursue. Remember: A voluntary assignment gives you more wiggle room than a court-ordered garnishment.

Garnishment Can Have Long-Term Financial Consequences

Garnishment is a legal avenue for creditors to take money from your paycheck or bank account and can seriously damage your lifestyle and credit score. It means you have less money for things like rent and food, which can make it tough to manage other bills.

Garnishment can also make it more difficult and expensive to get loans later. Plus, it’s harder to get a job involving handling money. management, or budgets if a garnishment appears on your credit report. That’s why it is vital to be proactive and deal with debts early to avoid the specter of garnishment.