A default occurs when you don’t make payments on your credit card or loan for an extended period, usually several months. It will damage your credit score, harm your future financing prospects, and may land you in court.

Many lenders and credit card issuers would rather prevent a default from occurring by working out a way to accommodate your situation. Credit counselors, many of them nonprofits, can advise you about your budget and finances if you are having trouble paying your bills.

In this article, I will cover strategies for avoiding and recovering from default. Whatever your circumstances, this article will help you understand the facts concerning default so that you can make informed decisions — or avoid it altogether.

Understanding Defaults

This section explores the basic concept of default in the context of credit and loans. You’ll learn about different types of defaults, how the process works, and how to detect when a default may be approaching.

Types of Defaults

Defaults come in several varieties. These are the different types of defaults you should know about:

- Strategic Default: This happens when you decide to stop paying a debt, even though you can afford to pay it. People often do this with mortgages when the home’s value drops below the loan amount. It’s also a strategy you can use when negotiating a debt settlement.

- Technical default occurs when you break a loan’s terms without missing a payment. For example, if a loan requires you to keep insurance on a car and you don’t, that’s a technical default.

- Loan Defaults: If you stop paying on a personal or secured loan, you are in default. This can lead to repossession or legal action.

- Credit Card Defaults: When you miss several credit card payments, the company may consider your account to be in default. They can raise your interest rate, close your account, and send your debt to a collection agency.

- Mortgage Defaults: Missing mortgage payments can lead to default. If you default on a mortgage, the lender can initiate foreclosure, which means they will take back your home to sell it and recover the money you owe.

All these default types share a common characteristic — they’re terrible for your credit. Let’s see how the default process works.

How the Process Unfolds

Default is akin to a slow-motion train wreck. Plenty of opportunities exist to halt the catastrophe by making even a token payment. However, if you do nothing, the process will unfold in a series of steps until it reaches its conclusion:

- Missed Payment: The process starts when you miss a payment. The lender will likely send you a reminder.

- Second Missed Payment: If you miss another payment, the lender will contact you again and warn you of the consequences.

- Third Missed Payment: Missing a third payment can lead to serious consequences. The lender may report you to the credit bureaus, which can harm your credit score.

- Late Fees and Penalties: The lender will add late fees and possibly a penalty interest rate to your account. These costs make it harder to catch up on payments.

- Account Default: Your account defaults after several missed payments. For credit cards, this may take six months. For loans, the timeline varies.

- Lender Actions: Once you default, the lender takes action to recover its money. This can include:

| Collections | The lender may send your account to a collection agency. The agency will try to get you to fork over what you owe. |

| Repossession | For defaulted auto loans, the lender can repo your car. |

| Foreclosure | For defaulted mortgages, the lender can take back your home and sell it to recover the money. |

| Lawsuits | The lender can sue you to get a court order for the debt. |

- Debt Settlement or Payment Plan: You can try to work out a settlement or payment plan with the lender to resolve the debt.

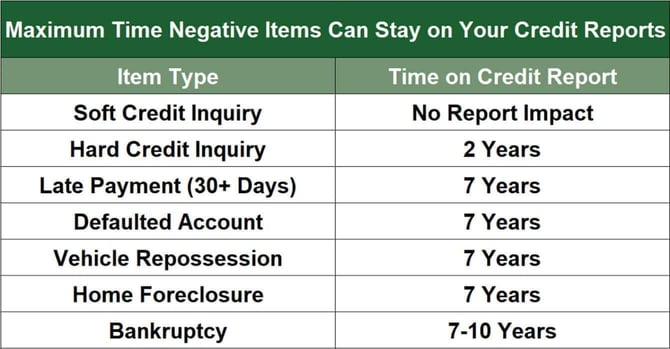

- Impact on Credit Score: Defaulting on a loan or credit card damages your credit score. It stays on your credit report for up to seven years.

This timeline shows the importance of making timely payments and contacting your lender if you have trouble paying. As the process progresses, you have fewer good options from which to choose.

Warning Signs of Potential Default

It would be nice to address your money problems before they result in a default. The following chart summarizes the early warning signs that you’re cruising for a financial bruising:

| WARNING SIGN | DESCRIPTION |

|---|---|

| Missed or Late Payments | If you start missing payments or paying your bills or loans late, it’s a warning sign that you might be struggling to keep up. |

| Maxed-Out Credit Cards | Using all your available credit and maxing out credit cards can signal trouble. It means you rely too much on credit. |

| Borrowing to Pay Off Debt | It should be a red flag when you take out new loans or use credit cards to pay off existing debt. You may be spiraling your way to default. |

| Dipping into Savings | Using your savings to cover regular expenses or pay off debts may mean you need to earn more money to pay for your expenses. |

| Frequent Overdrafts | Regularly overdrawing your bank account can lead to missed payments and default. |

| Calls from Creditors | Getting calls from creditors is a sign you’re at risk because you’re already behind on your payments. |

| High Debt-to-Income Ratio | If your monthly debt payments consume a large part of your income, you might need more money left for other expenses, which can lead to default. |

| Job Loss or Reduced Income | Losing your job or reducing your income makes it harder to pay your bills and loans. This puts you at risk of default. |

| Ignoring Bills and Statements | Not opening or ignoring bills and financial statements can indicate distress, as it shows you’re avoiding dealing with your financial situation. |

| No Emergency Fund | Not having savings for emergencies leaves you vulnerable. If unexpected expenses come up, you may miss payments and risk defaulting. |

You need to recognize these warning signs early so you can take action to avoid default. I explore the various alternatives below.

How a Default Impacts Your Credit Score

Your credit score reflects a credit bureau’s estimation of your creditworthiness in a single number. The three major bureaus — Experian, Equifax, and TransUnion — publish separate credit scores for consumers who have used credit or taken a loan.

Understanding Your Credit Score

FICO is the dominant credit scoring system for consumers. Your FICO score is a number that shows how well you manage your credit. It ranges from 300 to 850 and lenders use it when deciding whether to approve you for a loan or credit card.

A higher score means you are a lower risk to lenders, which makes it easier to get credit. A lower score makes it more difficult and expensive to borrow money.

Most creditors, including credit card companies and lenders, report your payment activity to the credit bureaus. They send information about whether you pay on time, how much you owe, and whether you miss payments.

The bureaus use this information to create your credit reports and independently calculate your FICO score. They look at several factors, including:

- Payment History: Whether you pay your bills on time

- Amounts Owed: How much debt you have

- Length of Credit History: How long you’ve had credit

- New Credit: How many new accounts do you have

- Types of Credit: The mix of credit cards, loans, and other accounts

Creditors report defaults to the credit bureaus, which will damage your credit score. A lower score makes getting loans, credit cards, and reasonable interest rates more challenging. It can also impact your ability to get a job or rent an apartment.

What Happens After a Default

Defaulting on a payment has a significant impact on your credit score, as it will drop when your creditor first reports the default. This is because payment history is the most critical part of your credit score.

A default stays on your credit report for up to seven years, which means anyone who checks your credit can see it. The impact is the worst in the beginning, but over time, the effect of the default on your credit score could wane if you get back on track. But it will still hurt your score until the bureaus remove it from your credit reports.

Your score can gradually improve if you make all your other payments on time and manage your credit well.

Long-Term Effects on Your Credit & Future Financing

Lenders see you as a higher risk if you have a default on your credit report. This makes it harder to get approved for new credit cards or loans.

If approved, you’ll likely pay higher interest rates. Lenders charge higher-risk borrowers more to protect themselves from monetary loss.

Creditors may give you lower credit limits when they see you as a risk. This means you can borrow only small sums and spend a limited amount on a credit card. Some landlords and employers also check credit reports, and a default can make renting an apartment or getting a job more difficult.

You may only qualify for secured credit cards or loans. These can help you rebuild credit, but you have to put down collateral to help guarantee payment. More negative marks will appear on your credit reports if a creditor charges off your debt and/or sends your debt to a collection agency, likely lowering your score even further.

Eventually, the negative items on your credit reports will expire. The worst offenses remain for seven to ten years. You can expect your bad scores to recover afterward, but only if you consistently exhibit creditworthy behavior.

The Legal Consequences of Default

Defaults can have severe legal consequences, as well. Lenders have the right to take action to get their money back, which can lead to various legal problems for you.

How Lenders Respond

Lenders often send your debt to a collection agency. The agency will reach out to you to try to get you to pay the debt. This can involve frequent calls and letters and may escalate into a lawsuit.

If you default on an auto loan, the lender can repossess your car. This means they take it back and sell it to recover the money you owe.

If you default on a mortgage, a lender can begin the foreclosure process. Eventually, it could take back your home and sell it to repay the debt.

Delinquent mortgages can signal to lenders that a borrower is at risk of defaulting. The table below shows states with high mortgage delinquency rates.

| State | Percentage of Mortgages 30-89 Days Delinquent* |

|---|---|

| Mississippi | 4.0% |

| Louisiana | 3.6% |

| West Virginia | 3.1% |

| Alabama | 2.7% |

| Texas | 2.6% |

A creditor can sue you to recover the money should you default on a debt. You’ll receive a legal summons and need to appear in court. If you lose the case, you may have to pay fines beyond the amount you owe.

Consumer Rights and Protections

The Fair Debt Collection Practices Act (FDCPA) protects you from abusive and unfair practices by debt collectors. Collectors can’t harass you, lie to you, or use dishonest methods to collect a debt.

In addition, you have the right to dispute any incorrect information in your credit report. If you think a creditor made a mistake when reporting a default, you can challenge the credit bureaus about these inaccuracies.

In extreme cases, you can consider filing for bankruptcy. This can discharge some debts and give you a fresh start. However, it does severe, long-term damage to your credit.

Potential Lawsuits and Judgments

The legal system can inflict misery upon a consumer in default in many ways. Here are some of the situations you may face:

- Lawsuits: If you default, the lender may sue you to recover the money. You’ll receive a court summons and need to appear before a judge.

- Judgments: If the lender wins the lawsuit, it will get a judgment against you. This is a court order that says you owe the money. The lender can use this judgment to take further action to collect the debt.

- Wage Garnishment: A lender can ask the court to garnish your wages with a court judgment. This means your employer takes money directly from your paycheck and sends it to your creditor.

- Bank Account Levy: The lender can get a court order to take money directly from your bank account to pay the debt.

- Property Liens: Sometimes, the lender can place a lien on your property. This means they can legally claim your property until you pay the debt.

Understanding the legal consequences of default should reinforce why making payments on time is crucial. If you’re struggling, contact your lender to discuss your options before things get worse.

Strategies to Avoid Default

The best default is the one that you avoid. This section offers strategies and methods to prevent defaulting on debts.

Restructure Your Debt

Debt restructuring involves changing the terms of your existing debt to make it more manageable. This can include lowering interest rates, extending the repayment period, or consolidating multiple debts into one loan.

The goal is to reduce your monthly payments and make it easier to repay what you owe. This can help you avoid default and improve your finances.

Here are some options:

- Refinance Loans: This can lower your interest rate and monthly payments.

- Debt Consolidation: Combine multiple debts into a single loan at a lower APR.

- Negotiate with Creditors: Contact your creditors to see if you can get better terms. They may agree to a lower interest rate, an extended repayment period, or reduced monthly payments.

- Modify Loan Terms: Ask your creditor to change your loan terms to make it easier to afford the payments.

Ultimately, it would be best if you found a way to reduce your monthly debt payments. But this will often require your creditors to cooperate.

Seek Professional Help

Sometimes, you may need expert advice to avoid default. Credit counseling is one of the best (and most affordable) ways to get help. A credit counseling agency can help you create a budget, manage your debt, and develop a plan to avoid default. Many are nonprofits and charge little or nothing for their services.

Some credit counseling agencies offer debt management plans. These plans can help consolidate your debts into one payment and may even lower your interest rates.

If you can afford it, you can hire a financial advisor to receive personalized advice. They can help you understand your options and create a personalized plan that fits your situation.

Find Assistance Programs

You need not face your financial challenges alone. Here is some more information on assistance programs that can help prevent default:

- Government Programs: Look into federal and state programs that offer financial assistance. Although HAMP expired in 2016, programs like the Flex Modification program offered by Fannie Mae and Freddie Mac aim to reduce mortgage payments by around 20%.

- Nonprofit Organizations: Many nonprofits offer financial help, including grants and interest-free loans. Examples include the National Foundation for Credit Counseling (NFCC) and United Way.

- Utility Assistance Programs: Some utility companies offer programs to help with bills. These programs can ensure you continue to receive essential services.

- Employer Assistance: Some employers offer financial wellness programs or emergency loans. Check with your HR department to see what’s available.

- State-Specific Programs: Many states have assistance programs for homeowners and renters. The California Housing Finance Agency offers mortgage assistance programs.

- Veterans Affairs (VA) Programs: The VA offers programs to help veterans with mortgage modifications and other housing-related financial assistance.

- Supplemental Nutrition Assistance Program (SNAP): SNAP helps low-income individuals and families buy food, freeing up funds to pay other bills.

- Temporary Assistance for Needy Families (TANF): TANF provides temporary financial assistance to low-income families, helping them cover basic needs.

- Local Housing Authorities: Local housing authorities often have programs to help with rent and utility payments. Check with your local office for available assistance.

You can reach out to many agencies online, including the United Way, Veterans Affairs (VA), and the National Foundation for Credit Counseling (NFCC),

How to Recover From a Default

After default, the most important thing you can do is make a plan and stick to it. It’s a good idea to start with a budget so you can track your income and expenses. This helps you see where your money goes and find areas to cut back.

Focus on paying essential bills first, such as housing, utilities, and loan payments. This helps ensure you make all the necessary payments. Contact your lenders if you need help. Many lenders offer hardship programs or payment plans to help you stay current.

Another helpful step is to set up automatic payments for your bills and loans. This ensures you pay on the due dates. An emergency fund is also a prudent idea because it can help cover unexpected expenses and avoid missed payments.

You can eventually recover from a default if you pay your bills on time and keep your debt levels relatively low. If you are still having trouble, seek out a nonprofit counseling agency near you to help you organize your finances.

Default Can Have Dire Implications That Linger for Years

Default can devastate your credit score, saddle you with higher interest rates, and make new loans unobtainable. It can also lead to lawsuits and garnished wages.

But don’t despair; you can recover. You need to learn how to better manage your money, perhaps by enlisting professional help or using assistance programs. These are your paths to a brighter financial future.