Debt consolidation is when you combine multiple debts — including loans and/or credit cards — into a single payment. By consolidating them, you make one monthly payment instead of many, and often at a lower interest rate.

It’s like putting all your debts into one basket, so you only have one payment to keep track of. This can make managing your money simpler, cheaper, and less sleep-disruptive. Keep reading, and I’ll tell you everything you need to know about debt consolidation.

Types of Debt Consolidation Loans

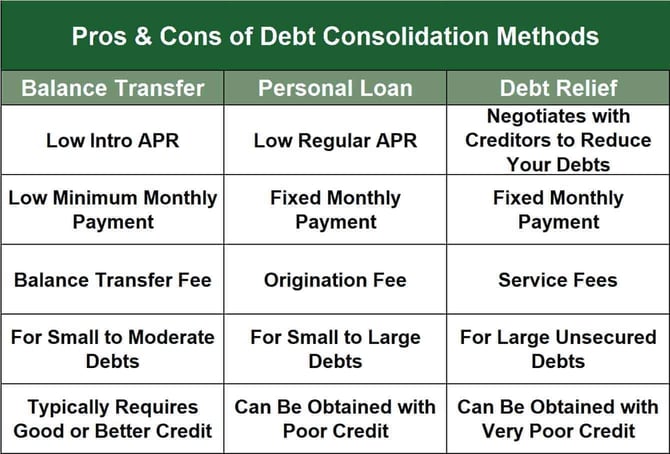

Here are the three most helpful methods for consolidating debt. If you are having trouble managing your finances, compare all three to see which one best suits your needs.

Personal Loans

An unsecured personal loan is money you borrow from a bank, credit union, or online lender that you pay back over time. For debt consolidation, you use this loan to pay off other debts, such as credit card balances or other loans.

You should apply for a personal loan that covers the total amount of your current debts. These are unsecured loans, so you don’t have to put up any collateral. This means you won’t lose your property if you can’t repay the loan, but your credit score will suffer.

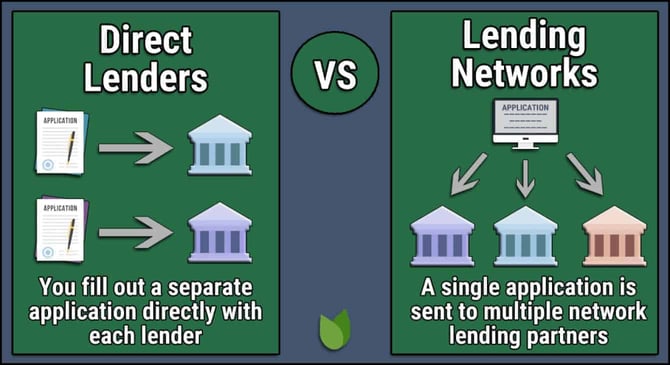

The easiest way to find a personal loan is to use an online service that matches borrowers with lenders. Many of the loan-finding networks cater to consumers with bad credit and do not charge any fees.

You start by entering some basic information about yourself, including how much money you need, your income, your housing costs, and your existing debts. You must be a U.S. resident, at least 18 years old, with a bank account, email address, and cellphone number.

The service will connect you with lenders that may be willing to work with you, along with the terms and estimated rates they offer. You can choose one or more lenders to apply to directly through the service, and it may transfer you to the direct lender you choose. There, you can complete the application and receive an immediate decision — a loan offer or a rejection.

Personal loans come with interest and fees. Interest is the extra money you pay to the lender for using their money, and it’s usually a percentage of the amount you borrowed expressed as an annual percentage rate (APR). Fees can include charges for processing your loan application or even for paying off your loan early.

The cost can vary widely based on your credit score, the lender, and the terms of your loan. If the lender offers you a personal loan, it will specify all the costs, the monthly payment amount, and the number of months you have to repay the loan.

You can accept the offer by e-signing the loan agreement. The loan proceeds should arrive in your bank account by the next business day. You can use the money from your loan to pay off all your smaller debts.

Now, instead of multiple payments, you make one monthly payment on this new loan.

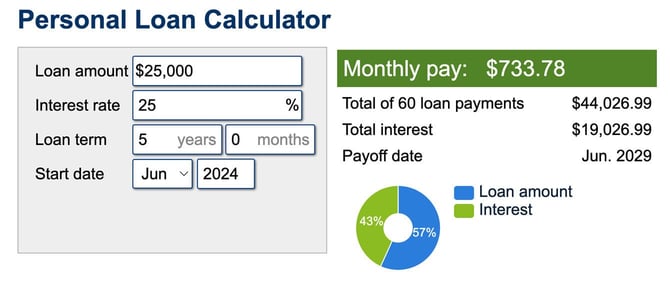

The amount you can borrow depends on your finances and your credit score. Typically, loans are available for $500 to $50,000, although you need good credit to qualify for larger loans. APRs for subprime personal loans often range from 17% to 36%.

You can use an online personal loan calculator to see how interest rates can impact your monthly payments and payback period. Until you repay your consolidation loan, you should avoid creating new debt. It may feel good to clear those smaller debts, but if you get a big consolidation loan and go on a spending spree, you could end up in more trouble.

To make a consolidation loan really work, you must commit to getting out of debt. This means you should stop using credit cards and focus on paying off what you owe.

Credit Card Balance Transfers

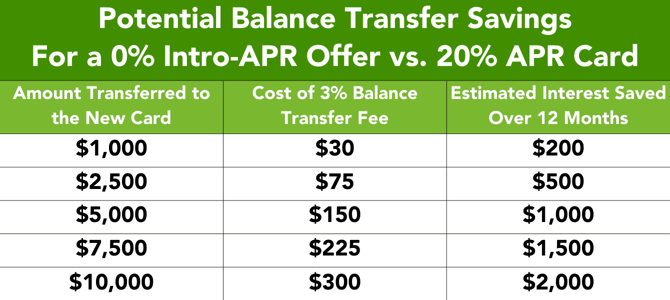

Credit card balance transfers are a way to move debt from one or more credit cards to a low-interest balance transfer card. This will save money on interest and eliminate multiple minimum payments each month. Balance transfer cards usually offer new card members a low or 0% introductory APR for six to 21 months.

You start by applying for a balance transfer card with a lower interest rate. Once approved, you inform the new card company about your old balances, and they will handle the transfers. You may even be able to request transfers when you apply for the card.

You’ll pay little or no interest on the transferred balances until the promotion period expires. After that, you’ll incur interest charges at the card’s regular APR. Obviously, the longer the promotional period, the more time you have to pay off all the old balances.

Some cards require you to request your balance transfers before a set deadline, often 60 to 90 days after opening the account. Most balance transfers come with a fee, usually around 3% to 5% of the amount transferred.

The issuer adds the fee to the new balance on your card. You can review these details by reading the cardmember agreement.

The balance transfer card’s credit limit determines the amount of money you can transfer. Naturally, you will prefer a card with a limit large enough to transfer all your credit card balances. This way, you’ll have to make only one card payment each month.

Keep paying the minimum amounts on your old credit cards until your issuer officially confirms the balance transfers are complete. Don’t worry if you end up paying more than you owe due to the transfers finishing before your payments process.

You can ask the credit card company to refund any extra money you spent. They may credit your statement, send you a check, or deposit the money back into your bank account.

It’s a good idea to put your credit cards away until you repay the remaining balance. Creating new debt before eliminating the old can leave you in hot water, financially.

Some balance transfer cards allow you to consolidate other types of loans, not just credit card debts. This may require a higher credit limit than the card issuer will give you if you need better credit.

Balance transfers can save you hundreds — or even thousands — of dollars in interest. Used wisely, they are an efficient way to consolidate and repay your credit card debt.

Home Equity Loans and Lines of Credit

Your home’s equity is the current resale price minus the mortgage balance. You can borrow against most of your equity through a home equity loan or a home equity line of credit.

You can use either type of secured loan to consolidate your credit card balances and other debts.

While having bad credit can make it tough to get a home equity loan, a recent bankruptcy can make it even harder. Bankruptcy is a major financial setback, and it makes lenders wary of offering loans to those who have just gone through one.

However, lender caution only lasts for a while, particularly if your home survived bankruptcy without any liens against it.

Lenders may be more willing to consider your equity loan application if you can offer your lien-free home as collateral.

Home Equity Loans

A home equity loan is a type of second mortgage. It does not change the payments on your main mortgage. The costs include both the principal and the interest, and the interest rate doesn’t change. This means your monthly payment amount is the same throughout the loan term, which helps you plan your budget without any surprises.

The lender uses your house as security for the loan. This means if you miss payments or pay late, the lender can take over your home (foreclosure).

If you decide to sell your house before you fully repay the loan, you will need to pay back the remaining balance of the home equity loan at the time of the sale. The money from the sale first goes to pay off your original mortgage before you can use it to pay off the home equity loan. Any money left after paying both loans goes to you.

A home equity loan can have a repayment period of up to 30 years, which can be as long as or even longer than your mortgage. Most have shorter terms, 10 years or less. If you borrow a reasonable amount, you can pay off the home equity loan faster than your mortgage.

Qualifying for a home equity loan starts with checking your credit score. A higher score helps you get approved more easily and with a lower interest rate. Consider improving your credit score first if it is under 620.

The next step is to check how much equity you have in your home. You gain home equity as you pay down your mortgage, and if property values go up, your equity increases faster.

Loan officers usually want you to have at least 15% to 20% equity in your home. The amount you can borrow varies by lender. Still, you can typically borrow up to 85% of your home’s value minus your mortgage balance.

To calculate the maximum amount you can borrow, use this calculation:

- Start by multiplying how much you could get for the house by the percentage the lender will let you borrow.

- Subtract how much you owe on your mortgage from this amount.

Let’s look at an example. Say your home would sell on the open market for $350,000. You currently still owe the bank $200,000 on the mortgage. You approach a lender who is willing to lend you 85% of your home’s value. We can compute the maximum consolidation loan as follows:

- $350,000 x 85% = $297,500

- $297,500 – $200,000 = $97,500

Next, check your debt-to-income ratio (DTI), which can impact loan approval. You calculate your DTI by dividing your total monthly debt payments by your monthly gross income and then multiplying by 100 to get a percentage. Lenders usually prefer that your DTI ratio, including the new home equity loan, is at most 43% of your monthly gross income.

This means that if your monthly gross income is $10,000, your total debts, including the new loan, should not exceed $4,300. Then, look into home equity loan rates from banks, credit unions, and online lenders. Start with your current financial institution or compare online through platforms such as eMortgage.

Loans typically take two to four weeks to close. You can smooth the process by having your pay stubs, the deed to your home, tax returns, and other required documents ready to go.

Understand that a home equity loan is not the same as a cash-out refinance. A cash-out refinance replaces your primary mortgage with a new one and allows you to take out extra cash against the equity of your home. In contrast, a home equity loan is a separate second mortgage on top of your existing one.

Home Equity Lines of Credit

A home equity lines of credit, or HELOC, lets homeowners borrow against the equity in their home, much like home equity loans. The amount you can borrow depends on your home’s equity, your credit profile, and market value.

HELOCs work like credit cards: You have a line of credit you can use as needed during a set draw period (typically five years). It’s helpful for consolidating debt, but it also has other uses.

Your HELOC payments depend on how much money you actually use, not the total credit you have. HELOCs often have variable interest rates, meaning rates can change. This can make HELOCs more expensive over time compared to home equity loans with a fixed interest rate.

| Home Equity Loan | Home Equity Line of Credit | |

|---|---|---|

| Interest Rate | Fixed Rate | Variable Rate |

| Repayment Term | 5-30 Years | 15-30 Years |

| Payout | Lump Sum | Revolving Credit |

| Loan Type | Secured | Secured |

| Best For… | Debt Consolidation, Major Upfront Renovation Expenses | Minor Renovations Performed Over Several Years |

With a HELOC, you can borrow money when you need it, pay it back, and then borrow again. This means lower monthly payments because you only pay interest on the money you use.

The interest rate on a HELOC is usually lower at the start, which is great for the first six to 12 months. However, the rate can increase after this introductory period.

Equity Loan Costs

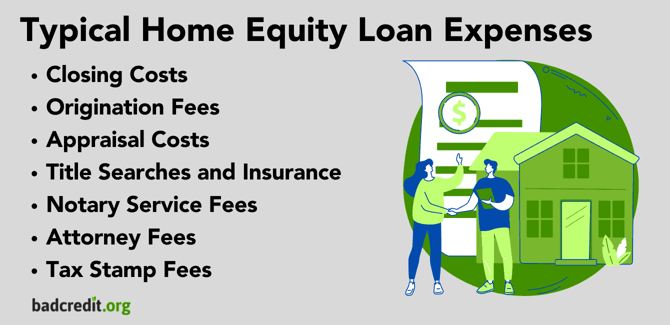

When you take out a home equity loan, expect to pay fees that both cover the lender’s expenses and allow them to make a profit. The lender will give you a loan estimate. This is a document required by the federal government that lists all fees and costs you’ll face.

You may have to pay between 2% to 6% of the loan amount in closing costs. For example, borrowing $100,000 could cost you $2,000 to $6,000 in fees.

The lender may charge an origination fee for processing your loan application. It can vary, and lenders may charge around $125. Some call it an application fee.

An appraisal costs $300 to $400. This fee is for a third party to assess your home’s value. Some lenders also charge a fee of around $25 to check your credit.

Title searches and insurance cost about $100, and insurance costs vary. These ensure there are no legal issues with your property’s ownership. Other miscellaneous fees pay for notary services, attorney fees of $100 to $400, tax stamp fees charged by your local government, and a floodplain determination fee if you live in a flood zone.

Keep an eye on other costs, such as prepayment penalties, required insurance (hazard or flood), and interest rates. There may be ongoing fees, such as annual membership fees or transaction fees, each time you borrow.

You can cut the loan costs in a few ways. Some lenders may waive certain fees, especially if you keep another account open with them or set up automatic payments.

Comparing lenders can also help you find the best interest rate and features, such as rolling the closing costs into the loan. This reduces upfront expenses but could increase the long-term cost because you pay interest on more money.

Make sure you can afford both the original mortgage and the home equity loan. Calculate the monthly payments and any other potential costs to ensure it comfortably fits within your budget. Consolidating your debts is great, but only if you can afford the payments.

Only borrow what you need to consolidate your existing debt. By borrowing the minimum, you can significantly reduce your closing costs and the loan amount, making it more affordable in the long run. Just as with your original mortgage, it pays to shop around and compare offers to find the best deal for your home equity loan.

How Consolidation Could Affect Your Credit

You may impact your credit when you consolidate your debts into one loan. It’s important to know how this works so you can manage your credit wisely.

Initial Repercussions

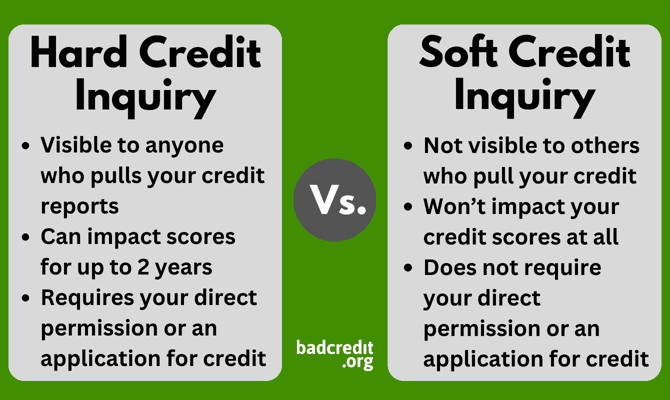

You start the ball rolling by opening a new loan or credit card account. This can impact your credit score for a few reasons. First, the lender will perform a hard credit inquiry, which can lower your score by a few points.

Second, you could be reducing the average age of your credit accounts (if you decide to close your old cards) which can also harm your credit score. Older accounts show a longer history of managing credit. On the positive side, you’ll bolster your credit score by lowering your credit utilization ratio if you consolidate via a new balance transfer credit card.

Long-Term Effects

After the initial changes to your credit score from opening a new account, debt consolidation can have more lasting effects; these are often positive if you manage your new account wisely.

Regularly making payments on time is crucial for improving your credit score. The lender reports your payments to a credit bureau. On-time payments bolster your credit history because they show that you are a responsible borrower.

By paying down your debts, you can reduce your overall credit utilization ratio. This ratio measures how much of your available credit you are using. A lower CUR (i.e., below 30%) can improve your credit score because it indicates that you are not overly reliant on credit and manage your debts well.

How to Consolidate Your Debt

Consolidating your debt (also called credit consolidation) means combining all your debts into one single payment through a loan or new credit line. This can make handling your money simpler.

Here’s how to get started:

1. Assess Your Financial Situation

Write down all your debts, including credit card debts, personal loans, and other money you owe. Record the interest rates, how much you pay each month, and how much you still owe.

Look at your income and spending each month. This will help you see how much you can really afford to pay toward your debts. This task will also help you figure out how big your consolidation loan should be and ensure you can manage the payments.

2. Research Financing Options

Check out different lending avenues, including personal loans, home equity loans, or credit card balance transfers. Pick the method that fits best with how much debt you have, your credit score, and what assets you own.

Look for options that offer a lower interest rate than what you currently pay. Check the length of the repayment period. Longer repayment periods can mean smaller monthly payments but may cost more in overall interest.

Research the lenders or credit card issuers. Read reviews and ratings from other customers on financial websites. Make sure the lender is well-regarded and clear about any fees and the terms of the loan.

3. Create a Repayment Plan

Make a budget that includes your new monthly payment. Ensure it covers all your costs and saves you money. Try not to take on new debts while you pay off your current one.

Keep to your budget and save money where you can, including some funds for emergencies. Then, try to save enough to cover three to six months of your spending. This can help you when unexpected costs come up and prevent you from needing to borrow more.

Debt consolidation can help you manage your debt, but it requires discipline and commitment. Stay on track with your long-term money goals, and keep working toward a debt-free life.

Debt Consolidation Benefits and Drawbacks

Debt consolidation can help you rebuild your credit. Still, it’s important to understand both the advantages and disadvantages before proceeding. Let’s look at the tradeoffs to see whether debt consolidation is right for you.

Benefits

- Simplified Payments: It’s easier to manage a single monthly payment than several with different due dates.

- Potential Lower Interest Rates: Installment loans (i.e., personal loans and home equity loans) usually have interest rates lower than those of credit cards. This can be a real money-saver over time.

- Fixed Payments: Your monthly payments on an installment loan don’t change because the repayment plan is fixed. This helps simplify your budget.

- Pay Off Debt Faster: Due to consolidation, more of your monthly payment goes toward the principal and less toward interest. That’s a better deal than minimum payments to credit cards, which go mostly toward interest. This can help you reduce your debt faster.

- Improve Your Credit Scores: Debt consolidation can boost your credit score. Just remember to pay on time and avoid taking on new debt.

Drawbacks

- Fees: Consolidating debt often involves balance transfer fees, loan closing costs, or origination fees. These fees can add up, so consider them when deciding if debt consolidation is worth it.

- Potential Negative Impact on Credit Scores: At first, debt consolidation may lower your credit score. Opening a new credit account usually leads to a hard inquiry on your credit report, which can drop your score for a little while.

- False Sense of Financial Security: Consolidating your debts may make you feel as if you’ve solved your financial problems, but it could lead to more debt if you manage your budget poorly or engage in counterproductive spending habits. Remember, debt consolidation should be part of a bigger financial plan.

Debt consolidation can simplify your payments, lower your interest rates, and help improve your credit score. However, be aware of the upfront costs and the impact on your credit profile.

Alternatives to Debt Consolidation

Consolidation can be an effective way to handle your debts, but you have other options. You may want help setting up a workable plan or prefer a strategy that impacts your credit but can reduce the amount you owe.

Debt Management Plans

A debt management plan (DMP) is a repayment strategy overseen by a credit counseling agency. These agencies, which often have nonprofit status, can work with your creditors to negotiate new terms for your debts, including repayment schedules and even waived fees or reduced interest rates.

These arrangements can simplify your payments, making them more manageable and helping you avoid default or bankruptcy. To get started, find a credit counselor to arrange the plan with your creditors. Once you have a plan in place, you make one monthly payment to the agency, which then distributes the funds to your creditors.

The agency may charge a small fee, but the savings from lower interest rates often offset this cost. Most plans aim to clear your debts within three to five years.

DMPs make sense because they can reduce your debt payments, making them easier to manage. Moreover, they help prevent the severe consequences of defaulting on your debts. You must close any credit cards you include in a DMP, which will reduce your access to credit and impact your credit score.

DIY Debt Payment vs. a Debt Management Plan

| DIY | Debt Management Plan | |

|---|---|---|

| Total Starting Debt | $21,377 | $21,377 |

| Average Interest Rate | 27.4% | 7.08% |

| Monthly Payment | 1% of principal plus interest | $453 (includes $25 fee) |

| Time to Payoff | 351 months | 49 months |

| Total Interest | $47,383 | $3,301 |

| DMP Fees | None | $1,264* |

| Total Cost | $68,760 | $25,942 |

DMPs generally apply only to unsecured debts, such as credit cards and personal loans and they don’t cover secured debts or student loans. You may face fees, which vary by agency and location, when joining a DMP. For example, the average setup fee is about $33, and the monthly payment is around $24.

Consider all of your options before choosing a DMP. A credit counselor can help you decide by reviewing your finances during the initial counseling session.

Debt Relief

Debt relief changes your debt. It can include partial loan forgiveness, debt consolidation, or specific government programs. You want to choose the most appropriate debt relief plan for your circumstances because they are all different, and some can destroy your credit.

Debt settlement is one version of debt relief. The settlement process can reduce your debt by working with creditors to forgive some of what you owe. It’s difficult to do on your own, so you’ll likely work with a debt settlement company that will set up a special account for you.

You fund this account each month with the money you’d normally use to pay your debts. The debt settlement company eventually uses this nest egg to pay your creditors after winning concessions.

This can be a hard-fought process, as creditors are seldom happy about forgiving debt. But if you get it to work, you may emerge from debt in two to four years. However, settling your debt for less will damage your credit score, and the stain will remain on your credit report for seven years.

Keep in mind that you will pay the debt settlement company a significant percentage of the debt it helps you settle. And you will likely owe taxes on any forgiven debt.

Consider these three options carefully — the right decision can improve your financial health, but the wrong one can harm it.

Consolidation Can Simplify Your Debt

Consolidating your debt can make managing your money easier. By turning several debts into one, you only have a single payment to remember each month. This can keep you organized and lower your stress.

Just make sure you pick a consolidation method that suits your financial needs and doesn’t kill your credit. If you are swimming in debt, consolidation can keep you from drowning.