Credit counseling is a service that provides help from a professional to better manage your money and debts. Counselors can help you plan to pay off your debts and guide you on how to manage your money wisely in the future.

In this article, I’ll provide plenty of information about the credit counseling process and offer tips on how to tell if you can benefit from it.

The Credit Counseling Process

You should first understand what happens when you work with a credit counselor. I’ll walk you through each step, from the initial meeting to making a plan for your debts.

The Initial Consultation

In your first meeting with a credit counselor, you will share your concerns and details about your finances. The counselor will ask you questions to learn about your income, including savings, spending habits, and how much debt you have.

This meeting provides a clear picture of your financial health so the counselor knows how best to help you. You don’t need to fix anything at this stage; just be open and honest about your financial situation.

A Financial Assessment

After your initial talk, the credit counselor will take a deeper dive into your finances. This includes reviewing your bank statements, bills, loan details, and any other financial documents you have.

This step helps them see exactly where your money is going each month, such as how much you spend on rent, food, or paying back loans. The counselor uses this information to determine where you can cut back on spending and how you can start saving money.

Evaluating Debt Management Plans

If your debts are high, the counselor may suggest creating a personalized debt management plan. This plan is made just for you and shows a clear path to paying off your debts. It includes who you owe money to and how much you owe, and it proposes a monthly payment that fits your budget.

| Steps a Credit Counselor May Suggest to Establish a Debt Management Plan: |

|---|

| 1. Track your expenses. |

| 2. Select a strategy for managing your debt. |

| 3. Contact lenders to negotiate more favorable interest rates on outstanding debt. |

| 4. Reduce your expenses. |

| 5. Make a habit of monitoring your credit report. |

Sometimes, the counselor can negotiate with your creditors to lower your interest rates or forgive part of your debt. The counselor may talk to the creditors and arrange an agreement that makes it easier for you to manage your debt. This plan aims to help you clear your debts in a structured way, often within three to five years.

Types of Debt Typically Addressed

Credit counseling can help you manage several types of debt, each with its own challenges. Here’s how credit counseling can assist you with each.

Credit Card Debt

Credit card debt can pile up because of high interest rates. Psychologically, spending with a credit card is much easier than using cash. Through credit counseling, you will learn strategies to manage and reduce your debt.

Credit counseling can help you create a detailed payment plan that matches your ability to pay. You may choose to negotiate with creditors to reduce your interest rates. You may also work out a plan to decide which credit cards to pay off first based on their rates and balances.

The counselor may also suggest techniques such as transferring balances to cards with lower interest rates or consolidating multiple credit card debts into a single, more manageable payment.

Student Loans

Student loans can overwhelm you due to their large size and long repayment terms. Credit counselors can help you manage these debts by explaining all available repayment options, including adjusting your monthly payments based on your income.

Cost of college 2023/2024 academic year:

| Public two-year, in district | Public four-year, in-state | Public four-year, out of state | Private nonprofit, four year |

|---|---|---|---|

| $13,960 | $24,030 | $41,920 | $56,190 |

Managing government and private student loans separately is also important because they have different rules. For federal government loans, you often have the option to lower your monthly payments based on your income. Counselors can also assist you in exploring consolidation to simplify payments or forgiveness programs that may erase part of your debt if you meet certain criteria, such as working in public service.

Private loans don’t usually offer this, and their interest rates can be higher. It’s a good idea to know these differences so you can plan the best way to pay back your loans.

Mortgages and Other Loans

You guarantee mortgages, car loans, and other secured debts with money or property. That’s why you must manage these loans correctly or you could be forced to forfeit your assets.

Suppose you lose your job or face some other financial hardship. In that case, you may jeopardize your ability to pay these loans and risk foreclosure or repossession. Credit counseling can help you understand and manage these large loans more effectively. This may involve attempting to adjust the loan terms, refinancing to get lower interest rates, or changing your budget to prioritize these payments.

Counselors can also advise you on what to do in an emergency, which could include temporarily reducing or pausing your payments.

Locate a Reputable Credit Counselor

You need to find a counselor you can trust to help you manage money and reduce debt. Consider these factors when you’re about to choose a credit counselor:

- Certification and Training: A counselor should be certified and trained by a recognized organization. This helps ensure they have the proper knowledge and skills.

- Reputation: Search for counselors that other people recommend. Check online reviews and ask for references.

- Fees: Understand all the costs involved. A reputable counselor will be clear about their fees and charge low prices.

- Nonprofit Status: Many reliable credit counseling agencies are nonprofits. This doesn’t mean their services are free, but they are more focused on helping you than making money.

- Services Offered: Make sure the credit counselor offers the services you need, such as debt management plans or budget counseling.

- Personal Approach: You want a counselor who will spend time to understand your specific situation. Counselors should offer personalized advice, not just general tips.

Selecting the right credit counselor can be a big deal. So, take the time to find a reliable and trustworthy person who can help you manage your debts effectively and stabilize your finances.

Look for An Accredited Organization

Identify a reputable credit counseling agency that has received accreditation from a recognized organization, such as the U.S. Department of Justice. The department publishes a list of approved credit counseling agencies that meet certain legal standards. The National Foundation for Credit Counseling (NFCC) and the Association for Financial Counseling & Planning Education (AFCPE) are two key organizations involved in the certification and accreditation of credit counseling agencies.

The NFCC ensures that credit counselors are knowledgeable and do their jobs well. If the NFCC approves a counseling agency, it meets high standards.

The AFCPE gives special approval to people, not places, who teach about money. They ensure counselors understand how to plan finances and provide good advice.

Both the NFCC and AFCPE certify that counselors and agencies giving financial advice are knowledgeable and work with integrity. The NFCC checks the places where counselors work, and the AFCPE checks the counselors individually.

When seeking someone to give you advice on your money, see if they have NFCC or AFCPE approval. This tells you they know what they’re doing.

Nonprofit vs. For-Profit Options

The type of counseling agency you dictate how much you’ll pay for the services it provides. Here are some comparisons between nonprofit and for-profit counselors:

| NONPROFIT CREDIT COUNSELING | FOR-PROFIT CREDIT COUNSELING | |

|---|---|---|

| Fee Structure | Often have lower fees or a sliding scale according to your ability to pay. | Typically have higher fees and may include additional charges. |

| Transparency | High transparency — they disclose all fees for counseling processes. | It may need to be more transparent; it is important to request full fee disclosure. |

| Focus | Mostly for educating and helping clients manage debt. | The focus may be more on profitability and selling services or products. |

| Services Offered | Typically includes budget counseling, debt management plans, and financial education. | May offer similar services but also focus on services that generate more revenue, such as debt settlement. |

| Regulatory Oversight | Often, they have more stringent regulatory requirements to maintain their nonprofit status. | Less regulatory scrutiny compared to nonprofit organizations. |

| Accessibility | Services may be more accessible due to lower costs and community-focused missions. | Services may be less accessible due to higher costs. |

Nonprofit agencies generally focus more on client education and charge lower fees. For-profit agencies may focus more on revenue and have higher fees. No matter which you choose, you should understand the services offered and the total cost before choosing an agency.

Read Testimonials and Reviews

It’s an excellent idea to read testimonials and reviews from other consumers when you’re looking for a credit counseling service. These insights can give you a real sense of the quality and effectiveness of the counseling. You may learn something about the staff’s professionalism and how previous clients felt about their experiences.

Here’s how you can learn what other people think about different credit counseling places:

- Better Business Bureau (BBB): The BBB has ratings and remarks about different places. You can see what people have said about how these places managed problems.

- Consumer Affairs: This website has lots of reviews where people talk about their own experiences with credit counseling services.

- Google Reviews: This is a quick way to see what people nearby say about local credit counseling agencies, both nonprofit and for-profit.

- Trustpilot: This site is often used for reviews of for-profit agencies, but it’s still good for seeing how happy people are with the services they receive.

- Reddit: Check out the r/PersonalFinance subreddit for personal stories and advice about credit counseling. People share their real experiences here, which can give you a clear idea of what to expect.

These sources are great for obtaining a full view of different credit counseling services before you decide where to seek help.

Compare Credit Counseling to Other Debt Relief Options

Credit counseling is just one way to deal with debt. There are other methods, too, including debt consolidation, debt settlement, and bankruptcy. Each one works in its own way and can be more appropriate in different situations. Let’s look at how they compare to credit counseling.

Debt Consolidation

Debt consolidation is a process in which you combine all your different debts into one. Your debt becomes easier to manage because you have just one payment to think about instead of many. There are two main ways to do this: credit card balance transfers and a debt consolidation loan.

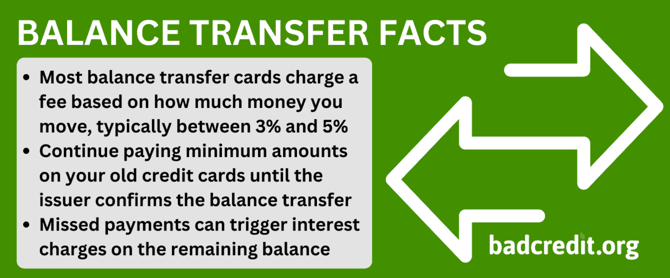

A credit card balance transfer is when you move all your different credit card debts onto one new card that usually has a lower interest rate. Better yet is a card with an introductory 0% APR promotion for a set period. This can be a suitable option if you have high credit card debts across multiple cards because it simplifies your payments and can reduce the amount of interest you pay.

However, it’s important to check how long the low rate lasts and what the rate will increase to when the promotion ends. You also need to consider the transactional fees (typically 3% to 5%) for transferring the balances.

A consolidation loan, on the other hand, involves taking out a new loan to pay off your debts. This loan may come from a bank, credit union, or other financial institution. As with balance transfers, the goal is getting lower interest rates than what you currently pay on your debts.

With a loan, you also benefit from the simplicity of one payment. The interest rate is usually fixed, so it won’t change over the life of the loan. This can make budgeting easier because you know exactly how much you need to pay each month.

Comparing the two, credit card balance transfers can be a good fit if you are confident you can pay off the debt during the low-interest promotional period. However, a consolidation loan may make more sense if you need more time to pay off your debt because it offers a stable payment plan over a longer period.

Both methods aim to lower your interest rate and consolidate your payments. Still, the right choice depends on your specific financial situation, how quickly you can repay the debt, and the terms and fees associated with each option.

Debt Settlement

Debt settlement is when you or someone on your behalf contacts the companies you owe and agrees to pay them less money all at once. This can be a viable option if you owe a lot of money and can’t make the minimum payments.

You usually work with a credit counselor or a debt settlement negotiator to help you through the process and manage the money. Here’s what to expect during the debt settlement process:

Assessment of Financial Situation: First, you and your advisor look closely at your budget and bills. You need to figure out how much you can really afford to pay. You’ll check your income, what you spend, your debts, and what you own. This step helps you understand what kind of offer you can make to your creditors that you can afford — and that they might accept.

Choosing a Debt Settlement Company: While you can talk to your creditors on your own, many people choose to work with a debt settlement company. These companies are good at dealing with creditors and can often get you better terms. If you decide to use a company, make sure it’s a good one. Look at its history and what other people say about it, and understand how much it costs before you agree to anything.

Setting Aside Funds for Settlement: In debt settlement, you usually stop paying your creditors directly. Instead, you can start saving a certain amount of money each month in a special account. The person helping you with your debt will use this money to make a one-time big payment to your creditors that you all agree on. Make sure to save the agreed amount every month so you have enough money to make a strong offer when it’s time.

Negotiation: Once you have enough funds saved, the negotiation process begins. This is when your debt settlement company earns its keep. It will negotiate with your creditors to accept a one-time lump sum payment that is less than the total amount owed. The goal is to settle your debt for a fraction of what you owe. The process can take several months, and you must be willing to stick with the plan.

Settlement and Payment: You must approve any agreement you reach. Once approved, your advisor will pay a lump sum from the escrow account. Upon receipt of the payment, the creditor will write off the remainder of the debt and close the account.

Debt settlement is not for the faint of heart. Understand that while it can relieve you of your debt load, it may also destroy your credit score. The credit bureaus record settled debts on your credit reports.

Report recipients will see that you paid less than what was owed. This will damage your ability to get credit in the future, although the impact will fade over time.

Bankruptcy

Bankruptcy is a legal procedure for dealing with debt problems when you can’t pay what you owe. When you file for bankruptcy, the court looks at your money and debts and helps you either wipe them out or plan to pay them.

It’s a serious decision with long-lasting effects on your financial health. In fact, it will negatively impact your credit for many years. In the United States, the most common forms of personal bankruptcy are Chapter 7 and Chapter 13. Each one caters to specific situations.

Chapter 7 Bankruptcy

Chapter 7, or liquidation bankruptcy, requires you to sell some of your assets to pay creditors. You can keep certain exempt property (which varies by state), including household furnishings, clothing, and possibly your car and home.

This chapter suits people with limited incomes who do not have significant assets to protect and who need a quick way to remove overwhelming debts.

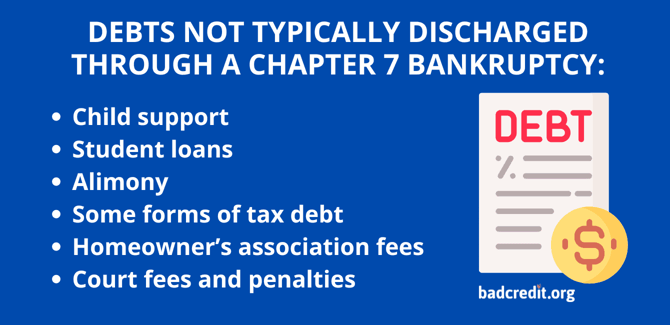

The process, which can take several months to complete, wipes out most of your debts, and creditors cannot try to collect them later. However, you will keep some obligations such as student loans, alimony, and child support.

Chapter 7 bankruptcies remain on your credit reports for 10 years.

Chapter 13 Bankruptcy

Unlike Chapter 7, Chapter 13 does not require you to sell your assets. Instead, it helps people with a regular income create a plan to repay all or part of their debts. Under this type of bankruptcy, you propose a repayment plan to make installments to creditors over three to five years.

One advantage of Chapter 13 is that it can provide relief from debt while allowing you to keep all your property, including non-exempt assets, that you may need to part with in a Chapter 7 case. It’s really helpful if you want to avoid foreclosure on your home or repossession of your car.

At the end of the repayment period, the court will discharge (i.e., forgive) most remaining debts. The repayment period may be long, and it will require strict budgeting and financial discipline.

Chapter 13 bankruptcies remain on your credit reports for seven years.

Chapter 7 or Chapter 13?

Your income, assets, and debts all figure into which bankruptcy chapter you can choose. Let’s compare the two:

Chapter 7 is best if you have little extra income and need a fresh start because you owe an overwhelming amount of unsecured debt, such as credit card balances and medical bills.

Chapter 13 is best if you have significant assets you want to protect and a steady income. You can use this method to set up a repayment plan.

Both bankruptcy types will hurt your credit score. They can make it hard to get new lines of credit for several years. Keep in mind that some debts (mainly secured ones) remain after bankruptcy.

Consider your circumstances and consult with a credit counselor, attorney, or other specialist to find the best path. You want to reduce the long-term fallout and get a new financial start.

Credit Counseling Can Teach You Financial Stability

Wouldn’t it be nice to replace your financial chaos with stability? Credit counselors help people accomplish that every day. After reading this article, I hope you will consider hiring one to help you fix your money problems.

If you find a nonprofit counselor, it may not even cost you a dime. Meaning you may have nothing to lose except the financial anxiety you feel.